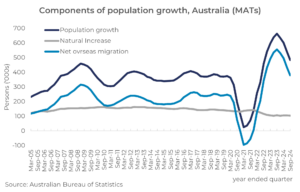

A quick snapshot of the September 2024 National Population data release last week by the Australian Bureau of Statistics suggests that Australia’s crazy rate of population growth is beginning to moderate.

- Net overseas migration (NOM) fell to 89,800 in September quarter 2024. Total NOM for the year to September 2024 was 380,000, 29% below the F2023 level of 535,500. Lower arrivals and rising departures both contributed to this reduction. While movements are starting to ‘normalise’, NOM is still tracking to be above pre-COVID levels in FY2025.

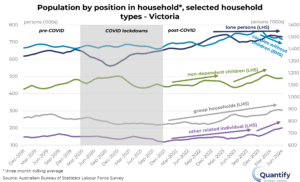

- Some 79,000 persons moved interstate in the quarter, down by 5% on September quarter 2023. Interstate mobility continues to decrease. Low unemployment, tight rental markets and a reduced house price differential between the states have reduced the influence of the traditional drivers of interstate migration. QLD and WA continue to experience net inflows, while VIC has now recorded two (modest) net inflows in the past three quarters. The net outflow from NSW decreased slightly reflecting the diminishing affordability of the destination states of QLD and WA relative to Sydney.

- The 76,800 registered births in the quarter were the highest quarterly total for some years but were influenced by the timing of registrations in Victoria. Births in the year to September 2024 (291,200) were on par with the prior twelve months (290,900). Australia’s total fertility rate (births per female) was 1.49 in FY2024, having fallen from 1.67 in FY2019. Flat births and further population growth suggest the fertility rate will drop further in FY2025.

- The number of deaths increased to 51,575 in September quarter 2024, the highest since September quarter 2022 when limited preventative care through COVID lockdowns caused deaths to subsequently spike.

A falling birth rate and rising deaths saw the natural increase fall to 104, 200 in the year to September 2024. This is nearly one quarter below the pre-COVID level of around 140,000 per annum. Deaths are now outpacing births for the first time in Tasmania, which recorded a negative natural increase.

Australia’s population grew by 484,000 in the year to September 2024, dropping below 500,000 per annum for the first time since 2022. NOM has been moderating at a pace slightly faster than suggested by the monthly overseas arrivals and departures data published by the ABS. Nevertheless, NOM for FY2025 is still likely to come in a little above the 320,000 projected by the Centre for Population.

Slowing NOM and population growth will provide some relief for rental markets. However, new dwelling completions are expected to remain below underlying demand over at least the next year or two and this will continue to maintain pressure on rental vacancies.

For further insight into what the implications of population growth nationally and across the states, contact Angie Zigomanis at angie.zigomanis@quantifysi.com.au or Rob Burgess at rob.burgess@quantifysi.com.au