Does it pay to get a degree?

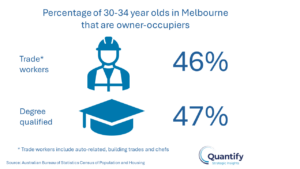

If we only take home ownership as soon as possible as the desired outcome, there is almost no difference whether you work in a trade or have a degree as a young adult, with almost half of 30-34 year olds of each being recorded as owner occupiers at the 2021 Census.

While many of those with a degree may arguably have a higher long-term earning potential, those in trades are likely to be earning income sooner, and typically do not have the burden of HELP debt in their younger years.

So, if you’re profiling a local area, don’t just focus on degree-qualified professionals. With shortages in most trades likely to continue in the coming years, tradies are an important part of any demographic analysis.

For more detailed demographic insights, please feel free to contact Rob Burgess or Angie Zigomanis.