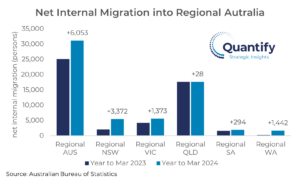

After subsiding in the immediate post-COVID aftermath, the level of net internal migration to the regions re-accelerated in the twelve months to March 2024.

The Australian Bureau of Statistics reports that net internal migration inflows outside of Australia’s capital cities increased by 24%, from 25,140 in the year to March 2023, to 31,190 in the year to March 2024, or by 6,050 persons year-on-year.

While Regional Queensland experiences the largest net internal inflows (approximately 17,700 persons), this number has been static in the past year. In contrast, there have been annual increases in net internal migration into Regional NSW (+3,372 to 5,513), Regional WA (+1,442 to 1,737), Regional VIC (+1,373 to 5,618) and Regional SA (+294 to 1,950).

All state regions recorded an increase in net inflows from their capital city, while in New South Wales and Victoria there has also been a noticeable reduction in the net outflows to the other states – likely a result of the outperformance of house prices and deterioration of relative affordability in QLD, SA and WA in this period.

The increase in net internal migration to the regions is likely to reflect challenges in capital city housing affordability as interest rates have risen, and this has implications for housing demand in areas that have already been under pressure from internal migration through the pandemic. It also places the onus on authorities to accelerate the process of opening up new development fronts to ensure there is enough affordable land to accommodate population growth.

If you’d like to know more about population trends into regional areas and what it can mean for your business, contact Rob Burgess or Angie Zigomanis.