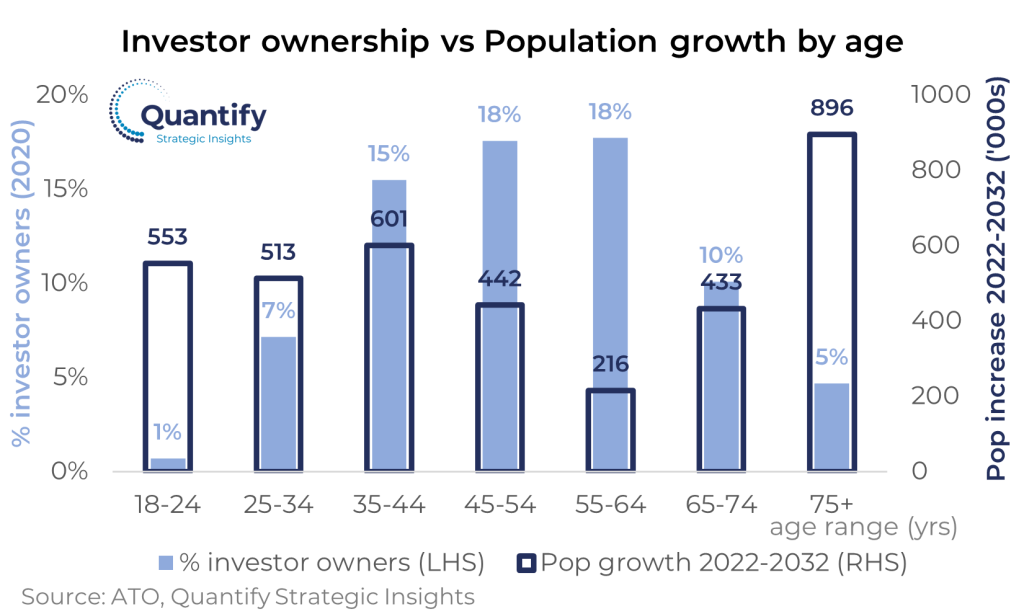

Significant demographic headwinds over the next decade will reduce the pool of ‘mum and dad’ investors able to drive new rental supply, which in turn will pave the way for a greater presence of Build-to-Rent (BTR) product in the market to fill the void:

- The segments of the population with the highest rates of investment property ownership (45-54 year old and 55-64 year olds) will have the lowest rate of population growth.

- At the same time, the age cohort with the fastest rate of population growth (75+ year olds), will decrease their rate of ownership as they divest investment property to help fund their retirement.

- Meanwhile, the fast-growing Millennial cohort (35-44 years old over the next decade) is likely to find it more difficult to purchase an investment property than previous generations as they deal with their own affordability challenges as owner occupiers.

While the stars are aligning for BTR, it should be noted that broader market rents will need to increase significantly further for BTR to move beyond the premium-priced end of the market and to financially justify the development of a mainstream product.

For help with where your project fits and how you can capitalise on the changing market, please do not hesitate to contact Quantify Strategic Insights’ principals: Rob Burgess at rob.burgess@quantifysi.com.au or Angie Zigomanis at angie.zigomanis@quantifysi.com.au