As stories of new migration patterns and movement across Australia’s cities and regions abound, updated population data shows that what initially appeared to be a pandemic-induced blip is instead the beginning of a reversal of a long-term trend. Emergent patterns of internal migration, together with the rise, and living preferences of the Millennial cohort, now present a genuine opportunity to address the seemingly unsolvable housing dilemma that has burdened the nation for two decades.

By 2019, the concentration of people in Sydney and Melbourne reached a level never seen in the nation’s history. With 40% of all Australians living in one of our two largest cities, the effects of this unique phenomenon were many, including, of course, the impact on house prices, with both cities consistently appearing near the top of the world’s most expensive housing surveys. The onset of the pandemic, however, saw the established patterns of population growth that shaped Australian cities in recent years, especially Sydney and Melbourne, come to a grinding halt.

Confronted with ongoing uncertainty regarding overseas migration and the prospect that it will continue to lose more people to internal migration than what it will gain, Melbourne remains in the throes of a demand shock, as it grapples with a downward shift in the dynamics that underpinned its rapid rate of growth over the last 15 years.

Nonetheless, new patterns of population continue to emerge.

Emerging Population Patterns

Though a direct challenge to the beneficiaries of recent growth patterns, emerging population trends have the potential to deliver significant social and economic gains, if managed proactively. Understanding the characteristics of those who are moving, how old they are, where they are going, and the type of dwellings they are seeking is the basis for ensuring these gains are delivered.

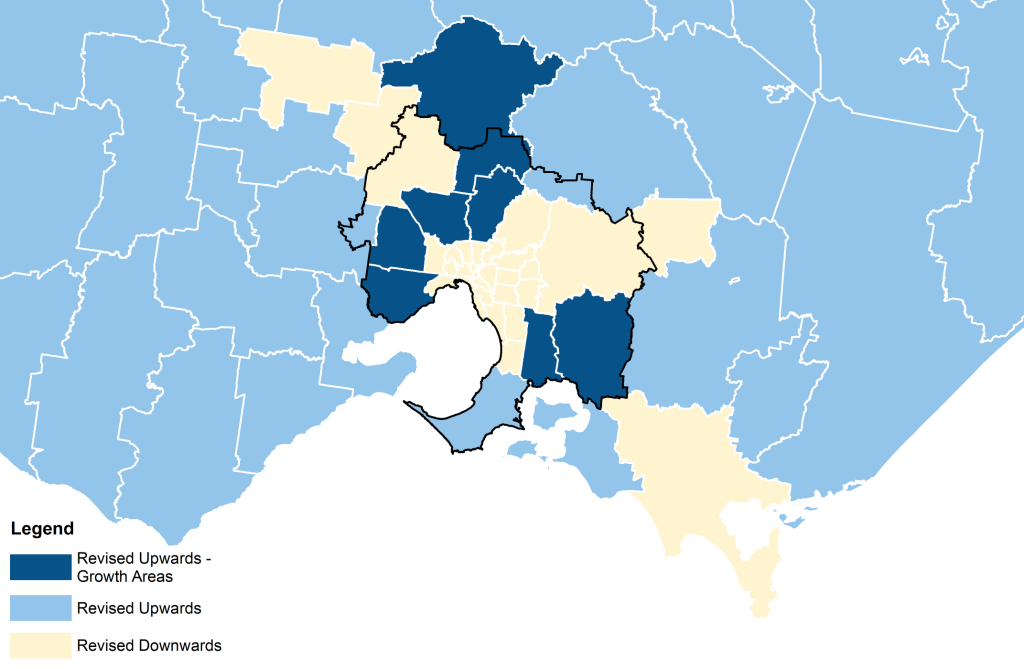

Having already accounted for the variety of Covid-inspired population shifts of the last two years, just released population estimates have again been revised upwards for each of Melbourne’s Growth Areas, many of its peri-urban locations, and the vast majority of the state’s regions. Add to this the unprecedented number of approvals for detached dwellings in Victoria in 2021 (48,000), despite significant population loss, the living preferences of a growing number of people suddenly look vastly different from those of the recent past.

Re-based Population Estimates – Metropolitan Melbourne & Surrounds

Growth Assumptions Redundant

Conversely, population estimates in all established, inner and middle metropolitan local government areas have been adjusted further downwards, dispelling the assumption of continued, consistent growth otherwise applied to justify housing policy frameworks, service planning, and infrastructure investment.

Combined with the take-up of technology, including online retail, telehealth, and remote work, this new reality has been foisted upon the agencies responsible for planning for and providing the necessary social and physical infrastructure for our communities. At the very least, the growth assumptions relied upon by these agencies should be reviewed as a matter of priority.

Rise of the Millennials

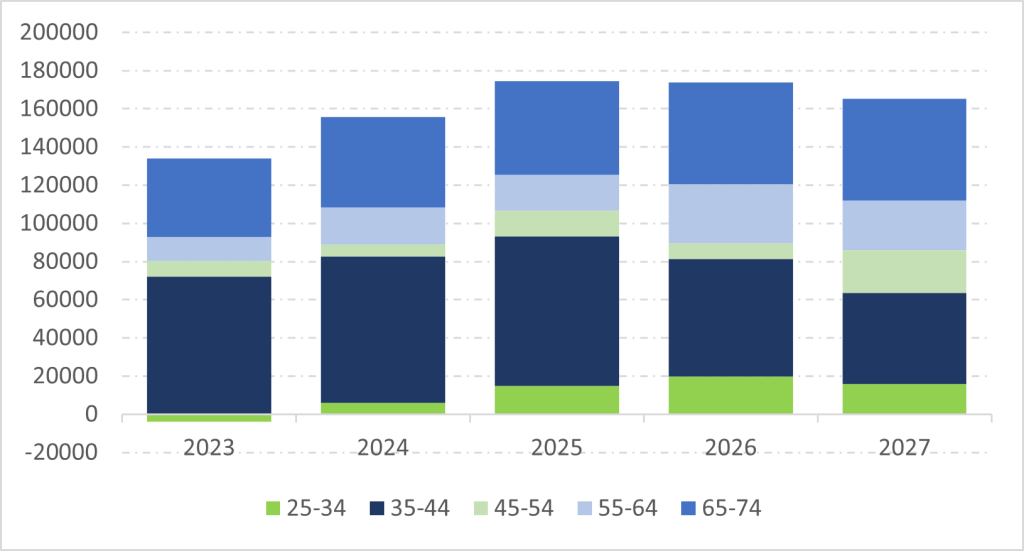

Recent Covid-inspired relocations aside, emergent population trends signal the arrival of a new chapter in the nation’s ongoing demographic story, with the headline being the significant growth in the number of 35-44-year-olds.

As the age group in which family formation is greatest, and with a strong preference for detached dwellings, it is the 35-44-year-old cohort that will generate the greatest demand for housing in coming years.

Annual Population Growth by Age Cohort 2023-2027 (Australia)

Keeping the Dream Alive

Encompassing a significant portion of the Millennial generation, where, how, and in what, the 35-44-year-old cohort will choose to live, is a defining question for contemporary Australian society. Few, if any social surveys will reveal as much about the direction of the nation, as the collective choices of the Millennial cohort in deciding whether to remain propertyless, lifelong renters, or pursue the great Australian dream, increasingly, somewhere in the regions. Representing the highest proportion of regional movers in the 12 months to March, for many Millennials, the dream remains well and truly alive.

In an already highly concentrated nation, the vast majority of Victoria’s population – heading towards 80% – resides within the boundary of metropolitan Melbourne. Whatever benefits this unique spatial phenomenon is deemed to deliver, improving deteriorating affordability, has not been one of them.

Opportunity Abounds

Multiple parliamentary inquiries, various Federal and state government incentives, monetary policy, and strategic planning frameworks have all failed to solve the affordability problem. An accident of the pandemic, together with a structural-demographic shift has however presented a genuine opportunity in which practical improvement to the housing quandary can be achieved.

The continued convergence of health, demographic and economic factors will see non-metropolitan locations become increasingly attractive places to live, particularly for the family-forming Millennial cohort. A coherent, tailored policy response that closely monitors key demand drivers with the express purpose to ensure the delivery of the requisite supply of housing in the many, increasingly popular sub-markets across the state, is crucial to enabling this.

Criticised for their prolonged adolescence, brunch options, and all-around lifestyle choices, younger Australians maintain an overriding aspiration for home ownership. If in the aftermath of the COVID-19 pandemic, the new reality presents a genuine opportunity to practically address the calamitous state of housing affordability, then surely, we are obliged to facilitate it.